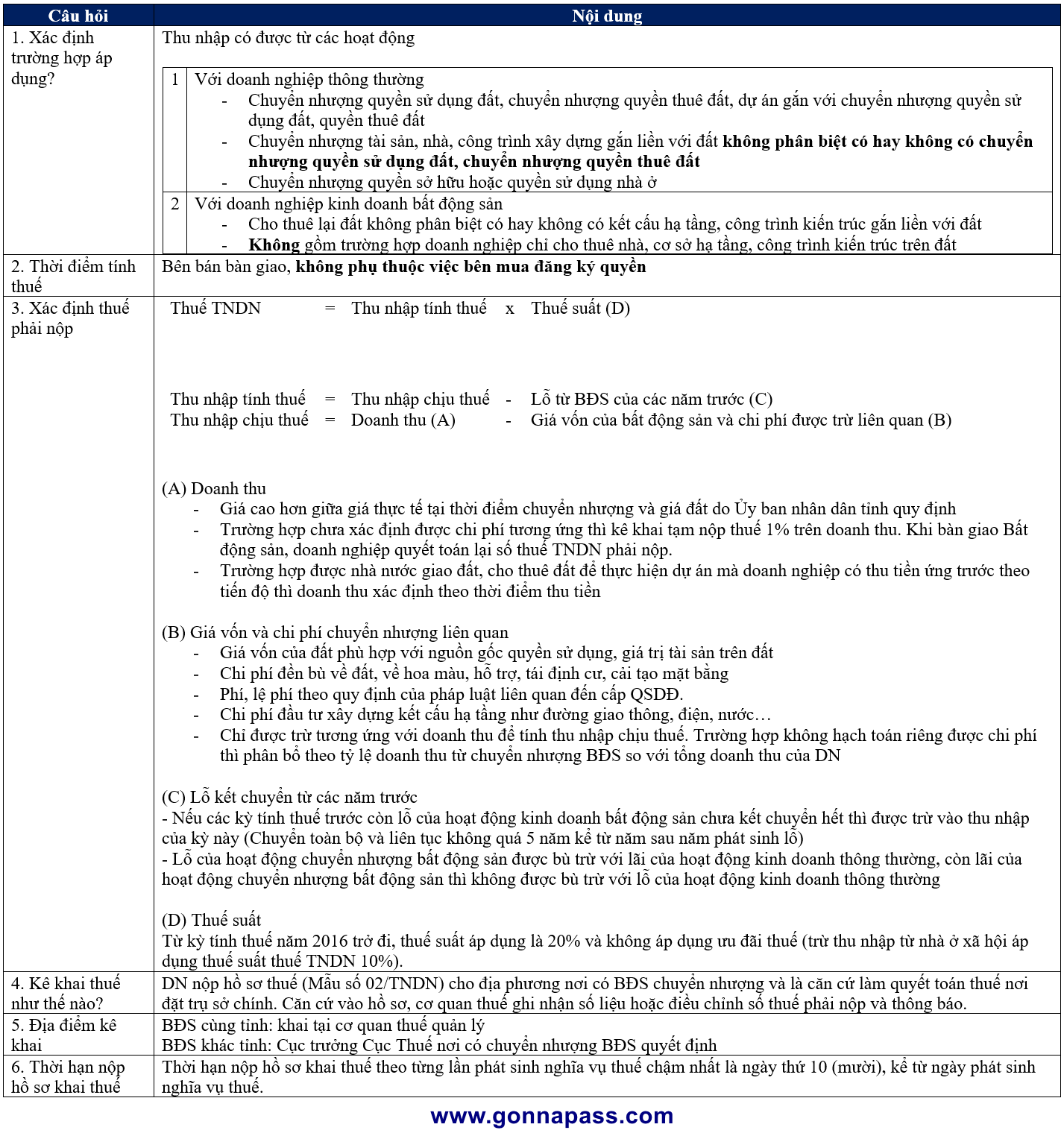

Trong hoạt động thực tế của doanh nghiệp có thể phát sinh thu nhập từ hoạt động chuyển nhượng bất động sản. Vậy các khoản thu nhập này có phải tính nộp thuế không? Những trường hợp nào phải tính thuế và cách tính thuế như thế nào?

Bài viết dưới đấy sẽ giúp bạn đọc xác định được các trường hợp các trường hợp cần kê khai tính nộp thuế cũng như cách tính thuế đối với thu nhập từ chuyển nhượng Bất động sản.

[spoiler title=’English version’ style=’default’ collapse_link=’true’]

The actual operation of the enterprise may generate income from the transfer of real estate. So are these incomes included for CIT calculation? In which cases and how to calculate taxes?

The article below will help readers determine in which cases need to declare tax for income from real estate and the tax calculation method for income from real estate.

| STT | Câu hỏi | |||||||||||||||

| 1. Application cases | Incomes from activity

|

|||||||||||||||

| 2. Tax calculation time | Date on handover minute, regardless of whether the buyer registers the rights or not | |||||||||||||||

| 3. Determine payable tax |

(A) Revenue – Higher prices between actual prices at the time of transfer and land prices prescribed by the Provincial People’s Committee – In case the corresponding cost has not been determined, temporarily declare 1% tax on turnover. When handing over Real Estate, the enterprise has to finalize the payable CIT amount. – In cases where the State allocates or leases land for the implementation of a project, if the enterprise collects advance payment according to schedule, the turnover shall be determined according to the time of money collection. (B) Cost and related transfer costs – Cost of land is consistent with the origin of the right to use and the value of assets on the land – Cost of compensation for land, crops, support, resettlement, ground improvement – Fees and charges in accordance with the law relating to the issuance of land use rights – Investment costs for infrastructure construction such as roads, electricity, water … – The expense is deductible corresponding to the revenue only. If expenses cannot be accounted separately, the proportion of revenue from real estate transfer to the total turnover of the enterprise shall be allocated

(C) Losses transferred from previous years – If the previous tax calculation periods still suffer from losses of real estate business activities which have not yet been fully transferred, they shall be deducted from the income of this period (fully and continuously transferred for not more than 5 years from the year after the year when the losses arise). – Losses of real estate transfers are offset against the profit of normal business activities, while the interest of real estate transfers is not offset against losses of normal business operations.

(D) Tax rate From the tax period of 2016 onwards, the applicable tax rate is 20% and tax incentives are not applied (except income from social housing, subject to 10% CIT rate). |

|||||||||||||||

| 4. How to declare tax? | Enterprises submit tax dossiers (Form No. 02/TNDN) to localities where properties are transferred and serve as a basis for tax finalization where the head office is located. Based on the records, the tax authorities shall record the data or adjust the payable and notified tax amounts. | |||||||||||||||

| 5. Place of declaration | Real estate placed in the same province: declared at the management tax office

Real estate placed in the different province: The director of the Tax Department where the property transfer is decided |

|||||||||||||||

| 6. Deadline for submission of tax declaration dossiers | The time limit for submission of tax declaration dossiers for each time of arising of tax liability is the 10th (ten) day at the latest from the date of arising tax obligations. |

[/spoiler]

Biên soạn: Nguyễn Văn Tĩnh – Tư vấn viên

Bản tin này chỉ mang tính chất tham khảo, không phải ý kiến tư vấn cụ thể cho bất kì trường hợp nào.

Để biết thêm thông tin cụ thể, xin vui lòng liên hệ với các chuyên viên tư vấn.

Đăng kí để nhận bản tin từ Gonnapass