Các doanh nghiệp sau một thời gian hoạt động và phát triển thường có xu hướng mở rộng thị trường kinh doanh. Một trong những phương thức mà các doanh nghiệp có thể lựa chọn đó là thành lập chi nhánh hoặc địa điểm kinh doanh. Trong đó, địa điểm kinh doanh là nơi mà doanh nghiệp tiến hành hoạt động kinh doanh cụ thể. Vậy địa điểm kinh doanh có cần đăng ký thuế không? Chính sách thuế với địa điểm kinh doanh gồm những gì?

Sự khác biệt cơ bản giữa thành lập chi nhánh và thành lập địa điểm kinh doanh là chi nhánh có thể hạch toán độc lập, sử dụng hóa đơn và con dấu riêng. Trong bài viết dưới đây, Gonnapass sẽ đưa đến cho bạn đọc tổng quan về chính sách thuế đối với địa điểm kinh doanh.

- Thông báo địa điểm kinh doanh:

Trong thời hạn 10 ngày làm việc, kể từ ngày quyết định lập địa điểm kinh doanh, doanh nghiệp gửi thông báo lập địa điểm kinh doanh đến Phòng Đăng ký kinh doanh nơi đặt địa điểm kinh doanh

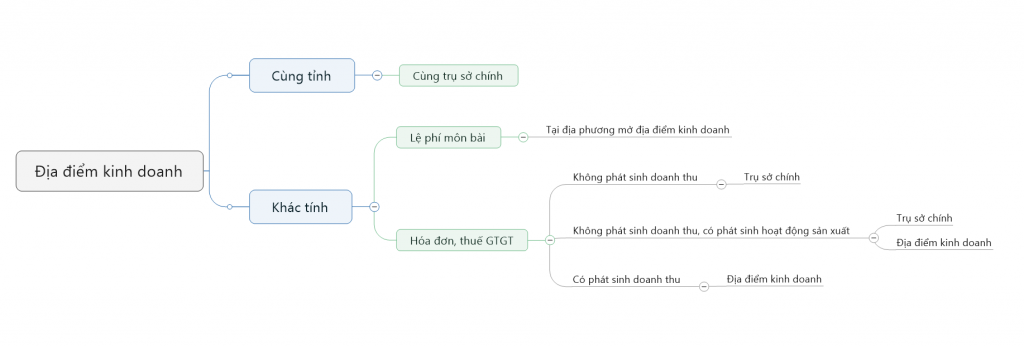

- Các nghĩa vụ thuế khác: Tóm tắt như dưới đây

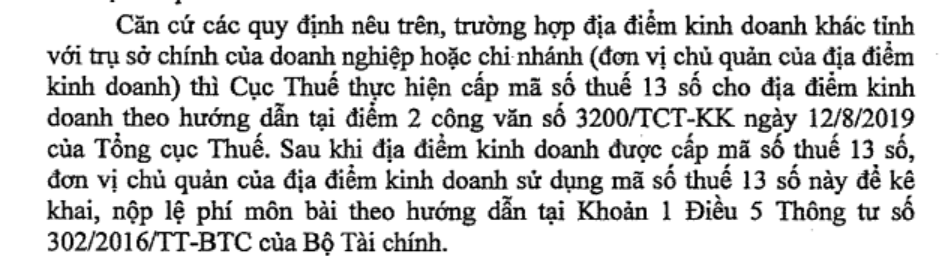

(Tham khảo thêm công văn 3200/TCT-KK)

Công văn 3302/TCT-KK

Tham khảo video:

[spoiler title=’English version’ style=’default’ collapse_link=’true’]

After a period of operation and development, enterprises often tend to expand the business market. One of the ways businesses can choose is to set up a branch or place of business. In particular, place of business is the place where businesses conduct specific business activities. Do business locations need to register for tax? What is the tax policy with a business location?

The basic difference between setting up a branch and setting up a place of business is that the branch is able to account independently, using its own invoices and seals. In the following article, Gonnapass will give readers an overview of the tax policy for business locations.

- Notice of business location:

Within 10 working days after deciding to set up a business location, the enterprise shall send a notice of setting up a business location to the Business Registration Office where the business location is located.

Tax authorities based on the information in the list of business locations assigned by the Department of Taxation to manage tax in the area, perform tax registration to issue tax code 13 digits for the business location, send the notice (form No. 11-MST) to the managing unit of the business location and the business location for information

- Tax of business location:

See more at Official letter No 3200/TCT-KK

…In case an enterprise or one of its branches establishes a business location in another province other than where the enterprise or its branch (provided the branch is assigned to manage the business location, to declare and pay taxes directly to its supervisory tax authority) is based. Currently, the General Department of Taxation has proposed the Ministry of Finance amendments to Circular No. 95/2016/TT-BTC. While waiting for the promulgation of Circular on amendments to Circular No. 95/2016/TT-BTC, the General Department of Taxation hereby requests the Tax Departments to follow these instructions:

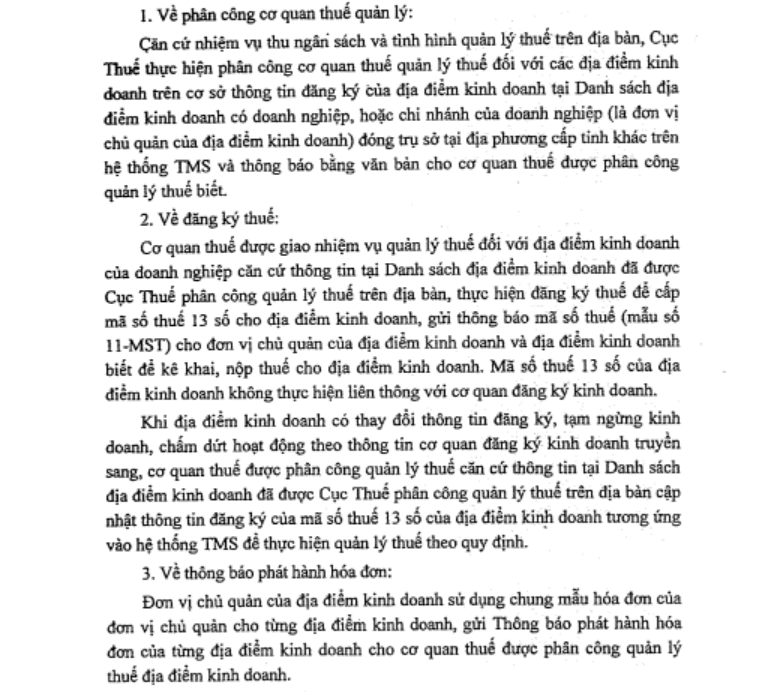

- Assignment of the supervisory tax authorities:

Based on the target revenue and tax administration developments within their provinces, the Departments of Taxation shall assign the tax authorities of the business locations based on their information registered in the list of business locations that are based in other provinces than those of their enterprises or their branches (the management bodies of the business locations) according to the Tax Management System and submit notifications to the tax authorities assigned to implement tax administration.

- Tax registration:

The supervisory tax authorities of the business locations of the enterprises, based on the information in the list of business locations allocated by the Departments of Taxation, shall issue 13-digit TINs to the business locations, send the notification of the TIN (form No. 11-MST) to the management bodies of the business locations and the business locations to enable them to declare and pay their taxes. The business registration agencies shall not issue 13-digit TINs.

in case a business location changes any of the registered information, suspend or terminate its operation as informed by the business registration agency, based on the information in the list of the business locations having supervisory tax authorities as assigned by the Departments of Taxation of the province, the assigned supervisory tax authority shall update the registered information relating the 13-digit TIN of the respective business location on the Tax Management System.

- Invoice issue notice:

The management bodies of the business locations shall use the same invoice template for every business location thereof and send the invoice issue notice of each business location to their supervisory tax authorities.

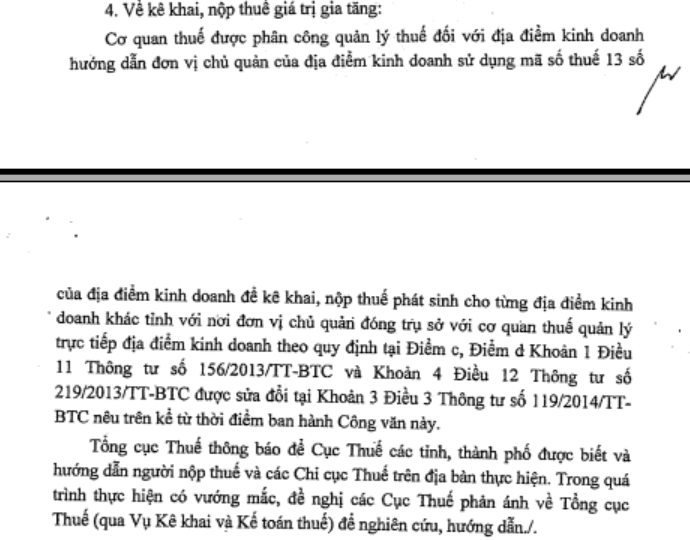

- VAT declaration and payment:

The assigned supervisory tax authorities of business locations shall instruct their management bodies to use the 13-digit TINs to declare and pay the taxes for each business location in provinces other than where the management bodies are based to the supervisory tax authorities of the business locations as specified in Point c, Point d Clause 1 Article 11 of Circular No. 156/2013/TT-BTC and Clause 4 Article 12 Circular No. 219/2013/TT-BTC receiving amendments under Clause 3 Article 3 of Circular No. 119/2014/TT-BTC mentioned above from the issuance date of this Official Dispatch.

[/spoiler]

Biên soạn: Lê Thị Minh Ngoan – Tư vấn viên

Bản tin này chỉ mang tính chất tham khảo, không phải ý kiến tư vấn cụ thể cho bất kì trường hợp nào.

Để biết thêm thông tin cụ thể, xin vui lòng liên hệ với các chuyên viên tư vấn.

Đăng kí để nhận bản tin từ Gonnapass